Tax deducted at source (TDS) must be deposited within the specified due dates. Below is the process to deposit TDS through electronic mode.

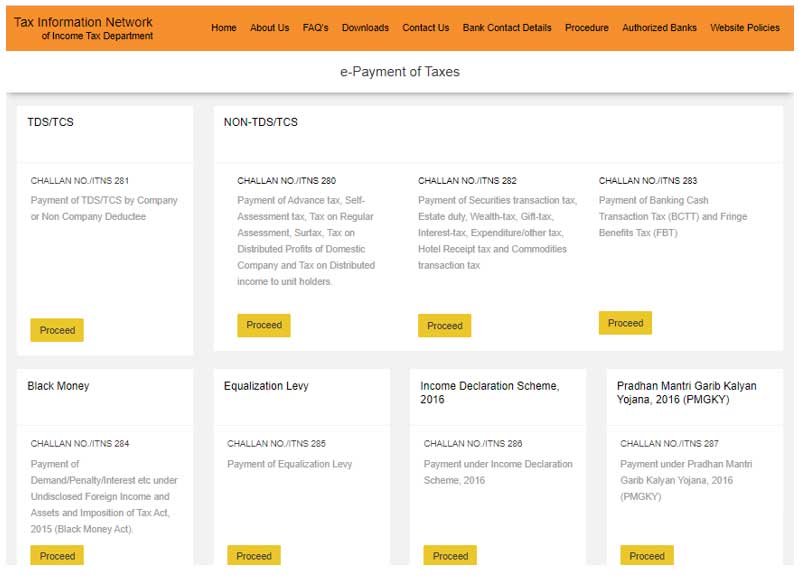

Step 1: Go to NSDL’s website for e-payment of taxes. (https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp)

Step 2: Select ‘CHALLAN NO./ITNS 281’ under TDS/TCS section. You will be directed to the e-payment page.

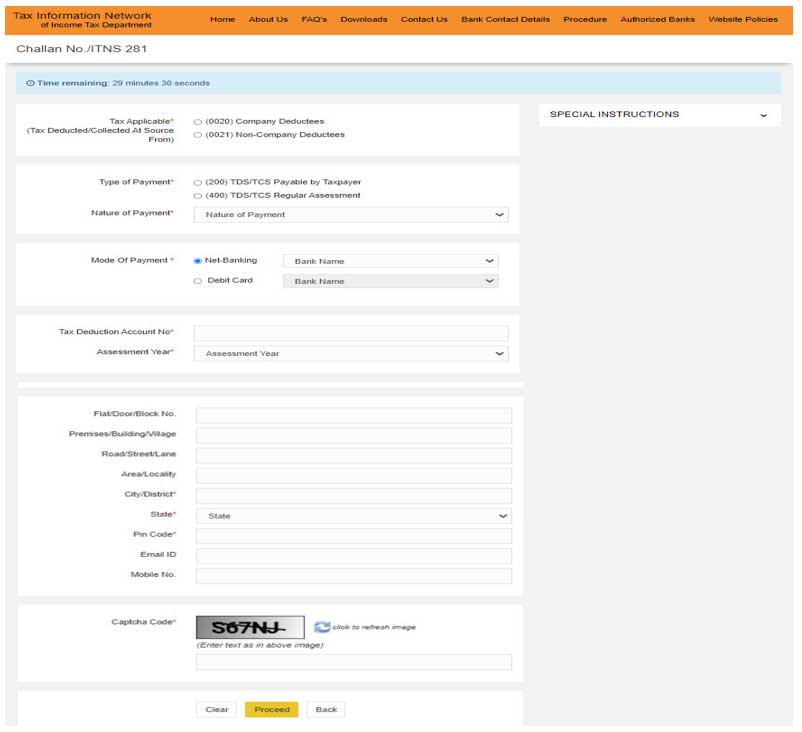

Step 3: On e-payment page, required details have to be entered.

Under ‘Tax Applicable’: Select Company Deductee, in case TDS deducted while making the payment to a company. In any other case select ‘Non-Compay Deductees’.

Under ‘Type of payment”:Select “(200)- TDS/TCS payble by Taxpayer”. In case, depositing TDS as a result of demand raised by income tax department then select “(400)-TDS/TCS regular assessment”

Under “Nature of Payment”: Select the relevant section under which TDS is deducted. Example: 192B, 94J, etc.

Under “Mode of payment”: Select the appropriate method of payment.

Enter the TAN and Assessment Year for which the payment is made.

Enter the ‘Pin Code’ and select ‘State’ from the drop down.

Enter Captcha code and clik on proceed.

Step 4: After clicking on “Proceed”, a confirmation screen will be displayed. If the TAN is valid, the full name of the taxpayer will be displayed on the confirmation screen.

Step 5: On confirmation of the data, you will be directed to the net banking portal of your bank.

Step 6: The taxpayer should log in to the net banking portal with the user id and password provided by the bank and make the payment.

Step 7: On successful payment, a challan will be displayed containing CIN, Challan serial number, Date of deposit, BSR code, Major Head Code with description, TAN, Name of the taxpayer, and bank name through which e-payment has been made. This challan is proof of the TDS payment.